Hardship Accommodation Plan SBA: What You Need to Know

Are you a small business owner struggling to make ends meet? Do you have outstanding debts with the Small Business Administration (SBA) that seem insurmountable? If so, you may be eligible for a Hardship Accommodation Plan SBA. In this article, we’ll break down what this plan is, how it works, and whether it’s right for you.

What is a Hardship Accommodation Plan SBA?

A Hardship Accommodation Plan SBA is a debt relief program offered by the SBA to help small business owners who are struggling to repay their debts. This plan allows you to temporarily suspend or reduce your loan payments, giving you time to get back on your feet. It’s a lifeline for businesses that are facing financial difficulties and need a little extra help to stay afloat.

Eligibility Requirements

To be eligible for a Hardship Accommodation Plan SBA, you’ll need to meet certain requirements. These include:

- Being a small business owner with an SBA loan

- Facing financial hardship that makes it difficult to repay your loan

- Having a good credit history (this is not always a requirement, but it can help)

- Being able to demonstrate a plan for how you’ll get back on your feet

How to Apply for a Hardship Accommodation Plan SBA

If you think you might be eligible for a Hardship Accommodation Plan SBA, here’s how to apply:

- Contact the SBA: Reach out to the SBA and let them know you’re struggling to repay your loan. They’ll send you an application package with instructions on how to proceed.

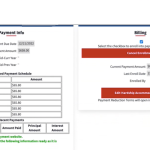

- Fill out the application: Fill out the application carefully, making sure to include all required information. You’ll need to provide financial statements, tax returns, and other documentation.

- Submit the application: Submit the application to the SBA for review. This may take a few weeks, so be patient.

What to Expect During the Application Process

During the application process, the SBA will review your financial situation to determine whether you’re eligible for a Hardship Accommodation Plan SBA. They’ll consider factors such as:

- Your business’s cash flow

- Your credit history

- Your ability to repay the loan

- The cause of your financial hardship (e.g., natural disaster, economic downturn)

What Happens Next?

If your application is approved, you’ll be offered a Hardship Accommodation Plan SBA that’s tailored to your specific situation. This plan may include:

- Temporary suspension of loan payments: This can give you some breathing room to get back on your feet.

- Reduced loan payments: If suspension isn’t possible, you may be able to reduce your loan payments for a set period.

- Interest-only payments: In some cases, you may be able to make interest-only payments for a set period.

Hardship Accommodation Plan SBA: What You Need to Know

Before you apply for a Hardship Accommodation Plan SBA, here are some things you should keep in mind:

- It’s not a forgiveness program: A Hardship Accommodation Plan SBA is not a forgiveness program. You’ll still have to repay your loan, but you may have more time to do so.

- It’s a temporary solution: A Hardship Accommodation Plan SBA is a temporary solution to help you get back on your feet. You’ll need to have a plan in place to get back to making regular loan payments as soon as possible.

- It may affect your credit score: A Hardship Accommodation Plan SBA may affect your credit score, so be sure to discuss this with the SBA.

Case Study: How a Hardship Accommodation Plan SBA Helped One Small Business Owner

Meet Jane, a small business owner who runs a bakery in a small town. Jane’s bakery was doing well until a natural disaster hit, causing her to lose a significant amount of business. She was struggling to repay her SBA loan and was worried about losing her business.

Jane reached out to the SBA and applied for a Hardship Accommodation Plan SBA. Her application was approved, and she was able to suspend her loan payments for six months. During this time, she was able to get back on her feet and develop a plan to repay her loan.

Thanks to the Hardship Accommodation Plan SBA, Jane was able to save her business and get back to making regular loan payments.

Conclusion

A Hardship Accommodation Plan SBA can be a lifeline for small business owners who are struggling to repay their debts. If you’re facing financial hardship and need some extra help, this plan may be right for you. Just remember that it’s a temporary solution, and you’ll need to have a plan in place to get back to making regular loan payments as soon as possible.

Hardship Accommodation Plan SBA: Final Thoughts

If you’re struggling to repay your SBA loan, don’t give up hope. Reach out to the SBA and explore your options, including a Hardship Accommodation Plan SBA. With the right plan in place, you can get back on your feet and keep your business thriving.

Hardship Accommodation Plan SBA: Get the Help You Need

Don’t let financial hardship hold you back. A Hardship Accommodation Plan SBA can help you get back on track. Apply today and take the first step towards securing your business’s future.

Hardship Accommodation Plan SBA: You’re Not Alone

If you’re struggling to repay your SBA loan, you’re not alone. Many small business owners have been in your shoes and have come out the other side. A Hardship Accommodation Plan SBA can help you do the same. Don’t be afraid to reach out and ask for help.

Hardship Accommodation Plan SBA: Take the First Step

If you’re ready to take the first step towards getting back on your feet, contact the SBA today to learn more about a Hardship Accommodation Plan SBA. You got this.

<