EIDL Hardship Accommodation Plan Extension: What You Need to Know

===========================================================

EIDL Hardship Accommodation Plan Extension: A Lifeline for Small Businesses

The COVID-19 pandemic has brought unprecedented challenges to small businesses worldwide. One of the most significant hurdles is managing debt and staying afloat during these uncertain times. If you’re a small business owner struggling to repay an Economic Injury Disaster Loan (EIDL) from the US Small Business Administration (SBA), the EIDL Hardship Accommodation Plan Extension might be the lifeline you need. In this article, we’ll break down the details of the EIDL hardship accommodation plan extension and what it means for you and your business.

Understanding EIDL Loans

Before we dive into the EIDL hardship accommodation plan extension, let’s quickly review what EIDL loans are. The SBA’s EIDL program provides low-interest, long-term loans to small businesses and non-profits affected by disasters or major economic downturns. These loans can be used to cover operational expenses, pay bills, and maintain essential functions. In response to the pandemic, the SBA has increased the loan limit to $2 million.

What is the EIDL Hardship Accommodation Plan Extension?

The EIDL hardship accommodation plan extension is a special program designed to help borrowers who are struggling to make payments on their EIDL loans. This temporary program allows eligible borrowers to extend their initial payment due date by 11 months, giving them much-needed breathing room to recover and rebuild.

Benefits of the EIDL Hardship Accommodation Plan Extension

- More time to recover: By extending the initial payment due date, borrowers get a longer runway to get back on their feet and start generating revenue.

- Reduced financial stress: The extra time to make payments can significantly reduce financial stress and allow borrowers to focus on rebuilding their businesses.

- No penalties or late fees: Borrowers won’t incur any penalties or late fees during the extended payment period, providing them with a chance to get their finances in order.

Eligibility Criteria for EIDL Hardship Accommodation Plan Extension

Not all borrowers are eligible for the EIDL hardship accommodation plan extension. To qualify, borrowers must meet the following criteria:

- Be an existing EIDL borrower

- Be experiencing hardship or significant financial difficulties due to the COVID-19 pandemic

- Not be in default or more than 90 days late on their loan payments

How to Apply for the EIDL Hardship Accommodation Plan Extension

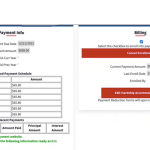

Applying for the EIDL hardship accommodation plan extension is relatively straightforward. Borrowers can submit their requests through the SBA’s online portal or contact their SBA servicing office directly. When applying, borrowers should have the following information ready:

- EIDL loan number

- Business name and contact information

- Reason for requesting the extension (e.g., pandemic-related financial hardship)

- Documentation supporting the hardship claim (e.g., financial statements, tax returns)

Tips for Borrowers: Making the Most of the EIDL Hardship Accommodation Plan Extension

- Review your loan terms: Make sure you understand your new payment schedule and any changes to your interest rate or fees.

- Communicate with the SBA: Keep your SBA servicing office informed about any changes in your business or financial situation.

- Create a recovery plan: Use the extra time to develop a solid recovery plan, including budgeting, revenue growth, and expense management strategies.

- Seek professional help: Consider working with a financial advisor or small business consultant to help you navigate the recovery process.

Conclusion: EIDL Hardship Accommodation Plan Extension

The EIDL hardship accommodation plan extension is a critical lifeline for small businesses struggling to repay their EIDL loans. By providing an extra 11 months to repay loans, this program gives borrowers much-needed breathing room to recover and rebuild. If you’re an EIDL borrower experiencing hardship, don’t wait – apply for the EIDL hardship accommodation plan extension today and take the first step towards a stronger financial future.

Next Steps for Borrowers

- Visit the SBA website for more information on the EIDL hardship accommodation plan extension.

- Contact your SBA servicing office to discuss your eligibility and application process.

- Review your loan terms and create a recovery plan to ensure a smooth transition.

In conclusion: EIDL Hardship Accommodation Plan Extension is a valuable resource for small business owners struggling to make ends meet during these challenging times.

<